Complete Guide to Liability Insurance for Contractors and Freelancers

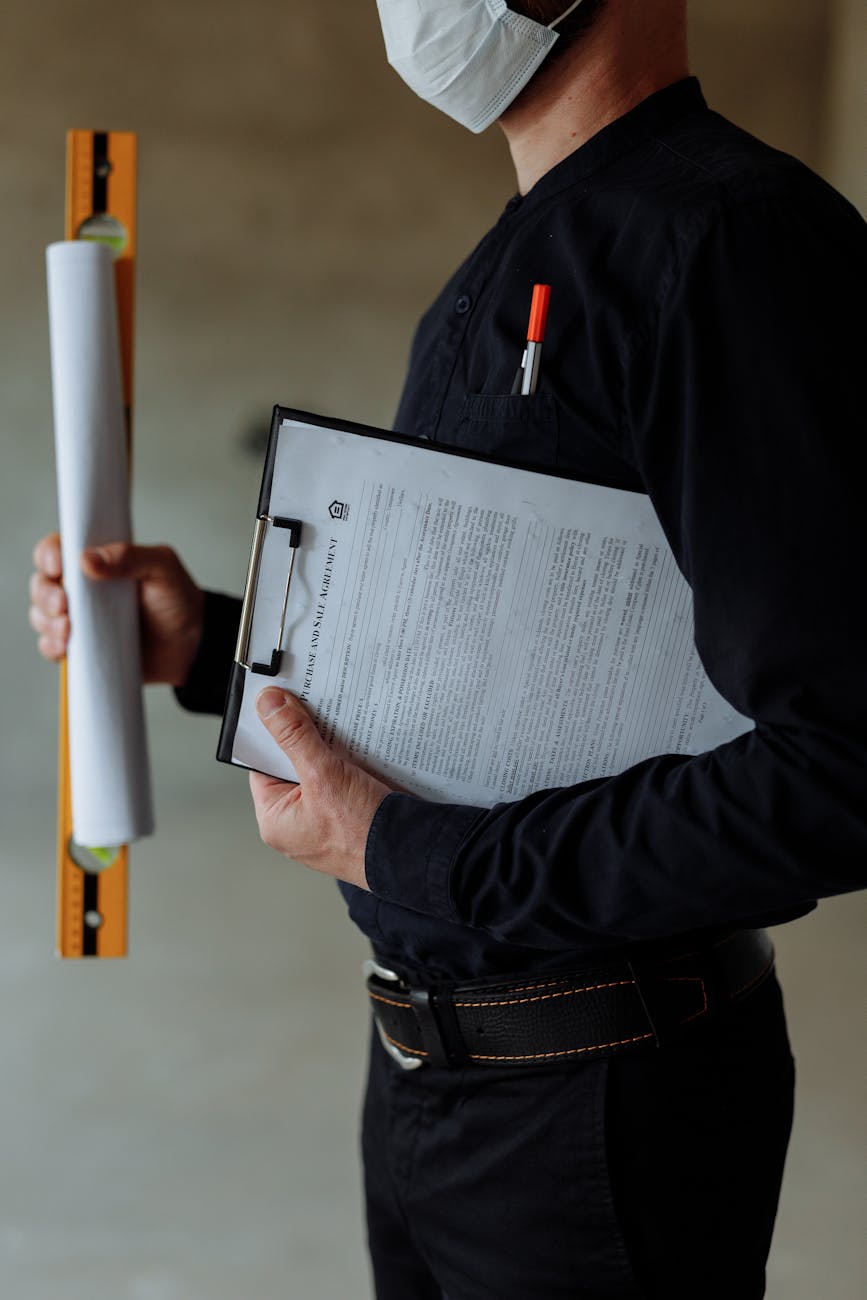

Complete guide to liability insurance for contractors and freelancers

Liability insurance is an essential safeguard for contractors and freelancers who want to protect their business and personal assets from unforeseen legal claims. Whether you are a builder, graphic designer, consultant, or any self-employed professional, understanding liability insurance helps you manage risks related to your work. This guide will cover what liability insurance entails, the types available, why it is crucial for independent professionals, and how to choose the right policy to fit your particular needs. By gaining a clear understanding of this insurance, contractors and freelancers can ensure they remain financially secure against accidents, mistakes, or negligence claims that could otherwise jeopardize their operations.

What is liability insurance and why it matters

Liability insurance protects contractors and freelancers by covering costs related to third-party claims of injury, property damage, or negligence that occur due to their professional activities. Unlike health or property insurance, liability insurance specifically addresses legal obligations resulting from accidental harm or mistakes in your work. Without it, you risk paying hefty legal fees, settlements, or judgments out-of-pocket, which can severely affect your financial stability. For contractors working on physical sites, this insurance often covers bodily injury or property damage claims. For freelancers, such as writers or consultants, it can protect against damages caused by professional errors or omissions.

The importance of liability insurance varies depending on your industry, client requirements, and contract terms. Many clients and regulatory bodies now require proof of liability coverage before awarding contracts, making this insurance not only a safety net but also a business necessity.

Types of liability insurance for contractors and freelancers

Understanding the different forms of liability insurance enables you to choose the best protection for your work. The most common types include:

- General liability insurance: Covers claims involving bodily injury, property damage, and advertising mistakes. It is the most basic form relevant to most contractors.

- Professional liability insurance (errors and omissions insurance): Protects against claims related to professional mistakes, negligence, or failure to deliver services as promised. Particularly important for freelancers providing consulting, design, or advisory services.

- Product liability insurance: Applies if you manufacture or supply products and protects against claims of injury or damage caused by those products.

- Pollution liability insurance: Important for contractors handling hazardous materials or working in environments where environmental damage claims might arise.

Choosing the right type or combination depends heavily on your specific scope of work and the risks involved.

How to choose the right liability insurance policy

Selecting the right liability insurance policy involves assessing your business risks, client requirements, and budget. Here are key factors to consider:

- Coverage limits: Typical policies offer limits ranging from $500,000 to $2 million. Higher risk work usually demands higher limits.

- Deductibles: Consider how much you will pay out of pocket before coverage kicks in. Lower deductibles mean higher premiums and vice versa.

- Claim handling: Evaluate the insurer’s reputation for processing claims quickly and fairly.

- Policy exclusions: Carefully read what is not covered to avoid surprises.

- Additional insureds: Sometimes clients require to be named as additional insureds on your policy.

Here is a brief overview of sample coverage options and estimated annual premiums for typical freelancer and contractor roles:

| Role | Type of insurance | Coverage limit | Estimated annual premium |

|---|---|---|---|

| Construction contractor | General liability & pollution liability | $1,000,000 | $1,200 – $2,500 |

| Graphic designer freelancer | Professional liability | $500,000 | $400 – $800 |

| IT consultant freelancer | Professional liability | $1,000,000 | $600 – $1,200 |

Steps to purchase and maintain liability insurance

Once you decide on the type and level of coverage needed, follow these steps to secure and maintain your liability insurance:

- Assess your risks: Consider your work scope, past claims (if any), and industry risks.

- Gather multiple quotes: Contact several insurance providers to compare coverage options and prices.

- Consult a broker if needed: An insurance broker can tailor policies and negotiate terms on your behalf.

- Review the contract carefully: Make sure you understand coverage limits, exclusions, and your responsibilities.

- Keep records and renew annually: Maintain documentation of your insurance and renew policies before expiry.

Regularly review your insurance as your business grows or changes to ensure consistent protection.

Conclusion

Liability insurance is a fundamental component of risk management for contractors and freelancers. It protects you from the financial fallout of accidental injury, property damage, or professional mistakes that could otherwise jeopardize your business sustainability. Understanding the different types of liability insurance available—general, professional, product, and pollution—helps you cater your coverage to your specific risks and clients’ demands. Choosing the right policy requires careful evaluation of coverage limits, deductibles, exclusions, and insurer reliability. Finally, maintaining your policy with annual reviews and prompt renewals ensures ongoing protection. By investing in liability insurance thoughtfully, contractors and freelancers can focus on growing their careers with confidence and peace of mind.

Image by: Thirdman

https://www.pexels.com/@thirdman

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua