Essential Tips for Choosing the Best Renters Insurance for Students

Essential Tips for Choosing the Best Renters Insurance for Students

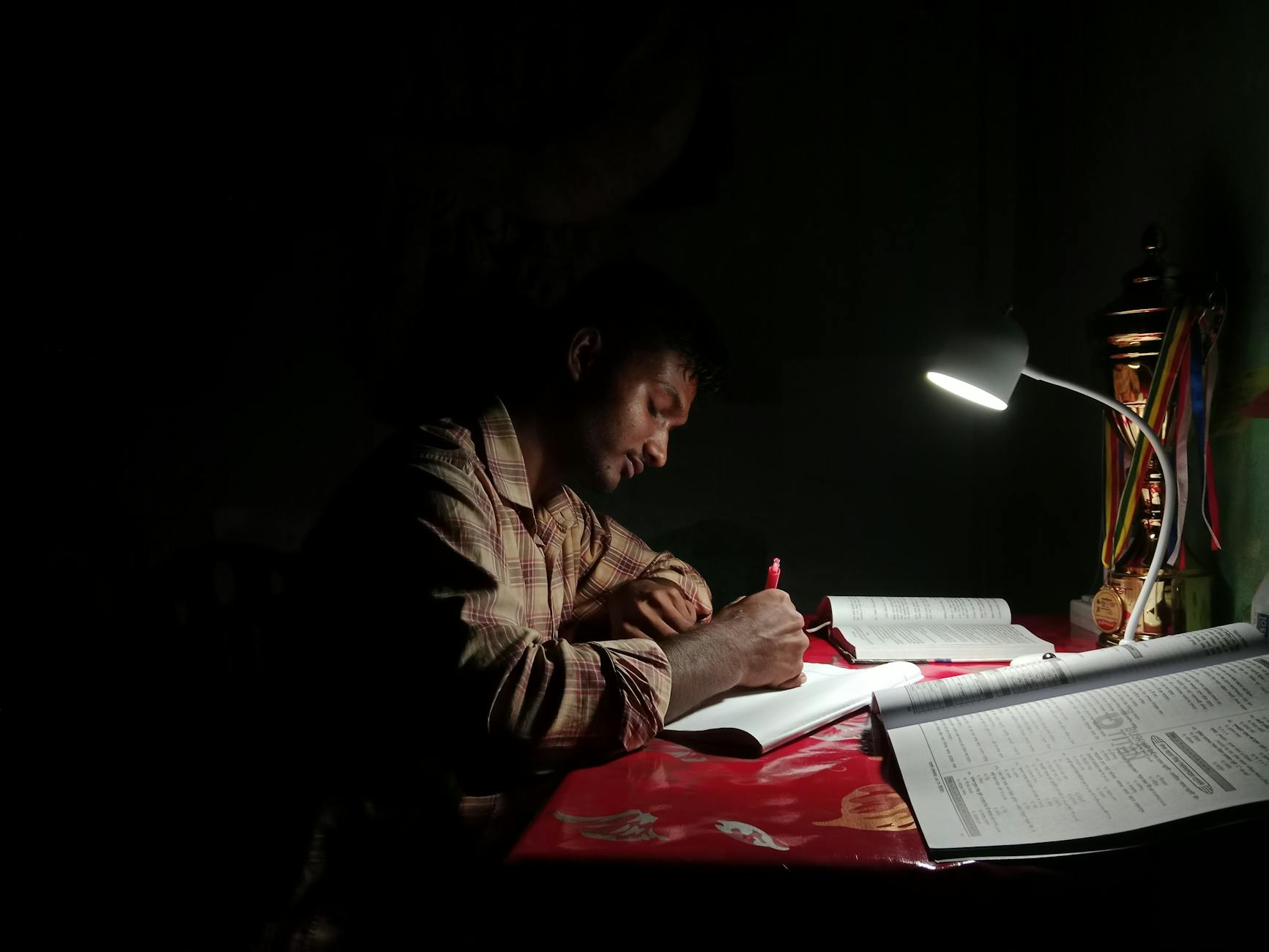

As a student, managing finances can be challenging, and finding affordable protection for your personal belongings often takes a backseat. However, renters insurance is a crucial safeguard that protects against theft, fire, or accidental damage to your possessions — whether you live in a dorm, shared apartment, or rental house. Choosing the right renters insurance policy tailored to a student’s unique lifestyle and budget is essential. This article will walk you through the key considerations to make an informed decision on renters insurance that offers the right coverage without unnecessary expenses. From understanding policy basics to evaluating coverage limits, deductibles, and discounts, these tips will help students secure peace of mind while focusing on their studies.

Understanding what renters insurance covers

Before diving into policies, it’s important to understand the core protections renters insurance provides. Typically, a standard renters insurance policy includes:

- Personal property coverage: Protects your belongings like electronics, furniture, and clothing from damage or theft.

- Liability coverage: Offers protection if you accidentally cause damage or injury to others within your rented space.

- Additional living expenses: Covers costs if you need temporary housing due to a covered loss like fire.

For students, certain unique risks—such as loss of expensive laptops or accidental damage to dorm room property—should be carefully considered when assessing coverage options. Not all policies offer the same limits or protections for valuables, so knowing what is included helps in shortlisting the right ones.

Determining how much coverage you need

Assigning a value to your belongings isn’t always straightforward, but it’s critical for adequate protection. Start by listing all your major possessions and estimating their current replacement costs. Consider electronics, bicycles, textbooks, and furniture as these often represent the highest value items for students.

When deciding on liability limits, $100,000 is often a baseline, but students who may host gatherings or have roommates should consider higher limits for extra security.

| Item category | Estimated value range | Recommended coverage amount |

|---|---|---|

| Electronics (laptop, phone, etc.) | $1,000 – $3,000 | $2,000 – $4,000 |

| Textbooks | $500 – $1,000 | $1,000 – $1,500 |

| Furniture | $1,500 – $3,000 | $2,000 – $4,000 |

Choosing the right deductible and premium balance

Finding the right deductible—the amount you pay out of pocket before insurance coverage kicks in—is a balancing act. A higher deductible typically lowers your monthly premium but means more upfront expense if you file a claim. For students on tight budgets, selecting a moderate deductible ($500 to $1,000) can help manage unexpected costs without breaking the bank.

When comparing premiums, ensure you’re evaluating policies with similar coverage limits and deductibles to make a fair comparison. Many insurance companies offer flexible payment plans, which can ease financial strain for students.

Looking for student discounts and policy add-ons

Many insurers offer discounts specifically for students, such as:

- Good student discounts for maintaining certain GPA thresholds

- Bundling discounts if you combine renters insurance with auto or other policies

- Security device discounts if your rental includes alarm systems or deadbolts

Additionally, consider add-ons like replacement cost coverage for personal property, which reimburses the full cost of new items rather than depreciated value, especially useful for expensive electronics. Another useful add-on can be identity theft protection, a concern for many young adults who frequently use digital services.

Conclusion

Choosing the best renters insurance for students requires understanding the scope of coverage, accurately evaluating the value of your belongings, and balancing deductibles and premiums to fit your financial situation. Being aware of available discounts and valuable policy add-ons can further optimize your protection while keeping costs manageable. Remember, renters insurance is not just an expense—it is a vital safety net that safeguards your possessions and provides peace of mind during your academic journey. Taking the time to research and compare policies will empower you to choose coverage that suits your unique needs, ensuring you’re financially protected against unexpected events without compromising your budget.

Image by: MT photography 😊📸📸

https://www.pexels.com/@mt-photography-503025765

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua